📈 Introducing Divergence-Weighted Clouds (DW) 1.0 🚀 Revolutionize your trading with an indicator that simplifies analysis by exclusively using price and volume data! The DW 1.0 Indicator integrates Divergence-Weighted Clouds, combining multiple metrics into a single, streamlined tool for enhanced clarity and actionable insights. _________________________________________ ✅ Key Features: 📊 Unified Input Data: DW relies solely on price and volume, delivering unmatched compatibility and ease of use. 🔄 ALMA-Based Trends: Advanced Adaptive Linear Moving Average calculations to identify market trends. 🔍 Divergence Detection: Highlight key divergences to spot market momentum shifts. 🎯 Multi-Metric Integration: Combines ADX, Aroon, and Chaikin Money Flow into divergence clouds—all derived from price and volume data. ⚙️ Customizable Settings: Tailor the indicator to fit your unique trading strategy effortlessly. _________________________________________ 💡 Why use it? DW offers a clean and efficient approach to technical analysis. By focusing exclusively on price and volume, it simplifies the process while delivering actionable insights, helping you detect trend continuations, reversals, or consolidations with confidence. 🌐 Try it out now: 🔁 Let’s collaborate and provide feedback. Together, we can refine this tool and elevate our trading game! 🚀 _________________________________________ ⚠️ Disclaimer: DW 1.0 is a powerful guidance tool but should be part of a broader trading strategy. Always practice responsible trading and incorporate risk management. #DivergenceWeightedClouds# #TechnicalAnalysis# #PriceVolumeAnalysis# #StockMarket# #TradingIndicators# #IchimokuClouds# #MarketTrends# #ADX# #Aroon# #ChaikinMoneyFlow# #ALMAIndicator# #FinancialMarkets# #TrendAnalysis# #MarketReversals# #PriceAction# #RiskManagement# #InvestmentStrategy# #NASDAQ# #NYSE# #LSE# #JPX# #SSE# #HKEX# #Euronext# #TSX# #BSE# #NSE# #ASX# #DAX# #CAC40# #FTSE# #BIST100# #TradingTools# #GlobalMarkets#

Elevate Your Trading with EMA Hierarchy Score V 1.0 🔍 A cutting-edge indicator designed to analyze and rank Exponential Moving Averages (EMAs) for a structured and actionable approach to market trends. ✅ Key Features: 🧮 Hierarchical EMA Analysis: Uses a unique scoring system to assess the relative positioning of EMAs, providing insights into trend strength. 📊 Customizable Settings: Tailor EMA periods, smoothing parameters, and Bollinger Band configurations to fit your trading style. 🚦 Trend Labels: Real-time "UP" and "DOWN" signals for instant feedback on market direction. 🔄 Volatility Insights: Integrated Bollinger Bands highlight breakout and reversion zones for better decision-making. ------------------------------------------------------------ 💡 Why use it? The EMA Hierarchy Score transforms complex EMA structures into a clear scoring system, offering traders precise insights into trend alignment and market dynamics. 🌐 Try it now: EMA Hierarchy Score V 1.0 ------------------------------------------------------------- 🔁 Your feedback matters: Test it out and share your thoughts to help refine this innovative tool! 🚀 ------------------------------------------------------------ ⚠️ Disclaimer: This tool is designed to enhance trading strategies but should not replace comprehensive market analysis. Practice responsible trading. #Trading# #EMA# #TechnicalAnalysis# #TrendAnalysis# #FinancialMarkets# #MarketTrends# #StockMarket# #NASDAQ# #NYSE# #JPX# #LSE# #SSE# #HKEX# #Euronext# #TSX# #BSE# #NSE# #ASX# #DAX# #CAC40# #FTSE# #BIST100# #KOSPI# #TWSE# #BMV# #JSE# #MOEX# #SIX# #TADAWUL# #SET# #PSEI# #IDX# #Sensex# #Nifty50# #EuroStoxx50# #IBEX35# #SMI# #OSE# #Bovespa# #Russell2000# #ShanghaiComposite# #HangSeng# #GlobalMarkets#

📈 Introducing the Volume and Price EMA Hierarchy Scoring Indicator V 1.1 🔍 Simplify your trading decisions with the ALLin1 Indicator, a powerful tool designed to enhance your understanding of market trends by integrating multiple metrics derived from price and volume. ------------------------------------------------------------- ✅ Key Features: 📊 ALMA Calculations: Enhanced trend detection with Adaptive Linear Moving Averages. 🧮 EMA Hierarchy Scoring: Analyze relationships across exponential moving averages with precision. 🔄 Volume Integration: Leverages volume to amplify trend signals and reversals. 🎛️ Customizable Settings: Tailor inputs for ALMA, Aroon, ADX, and other modules to match your strategy. -------------------------------------------------------------- 💡 Why use it? This indicator consolidates complex calculations into a single, streamlined tool, ensuring clarity and actionable insights. It’s perfect for traders looking to optimize their trend and volume analysis. 🌐 Explore it here: Volume and Price EMA Hierarchy Scoring Relations V 1.1 🔁 Feedback is vital: Test the indicator and share your experiences to help us improve! 🚀 ----------------------------------------------------- ⚠️ Disclaimer: This indicator is intended as a guidance tool and should not be relied on as the sole basis for trading decisions. Always use in conjunction with a comprehensive trading strategy. #Trading# #TechnicalAnalysis# #PriceAction# #EMA# #ADX# #Aroon# #MarketTrends# #RiskManagement# #FinancialMarkets# #ChartAnalysis# #VolumeAnalysis# #NYSE# #NASDAQ# #JPX# #LSE# #SSE# #HKEX# #Euronext# #TSX# #BSE# #NSE# #ASX# #DAX# #CAC40# #FTSE# #BIST100# #KOSPI# #TWSE# #BMV# #JSE# #MOEX# #SIX# #TADAWUL# #SET# #PSEI# #IDX# #BSE500# #CSI300# #MSCIWorld# #Sensex# #Nifty50# #EuroStoxx50# #IBEX35# #SMI# #OSE# #Bovespa# #Russell2000# #ShanghaiComposite# #HangSeng#

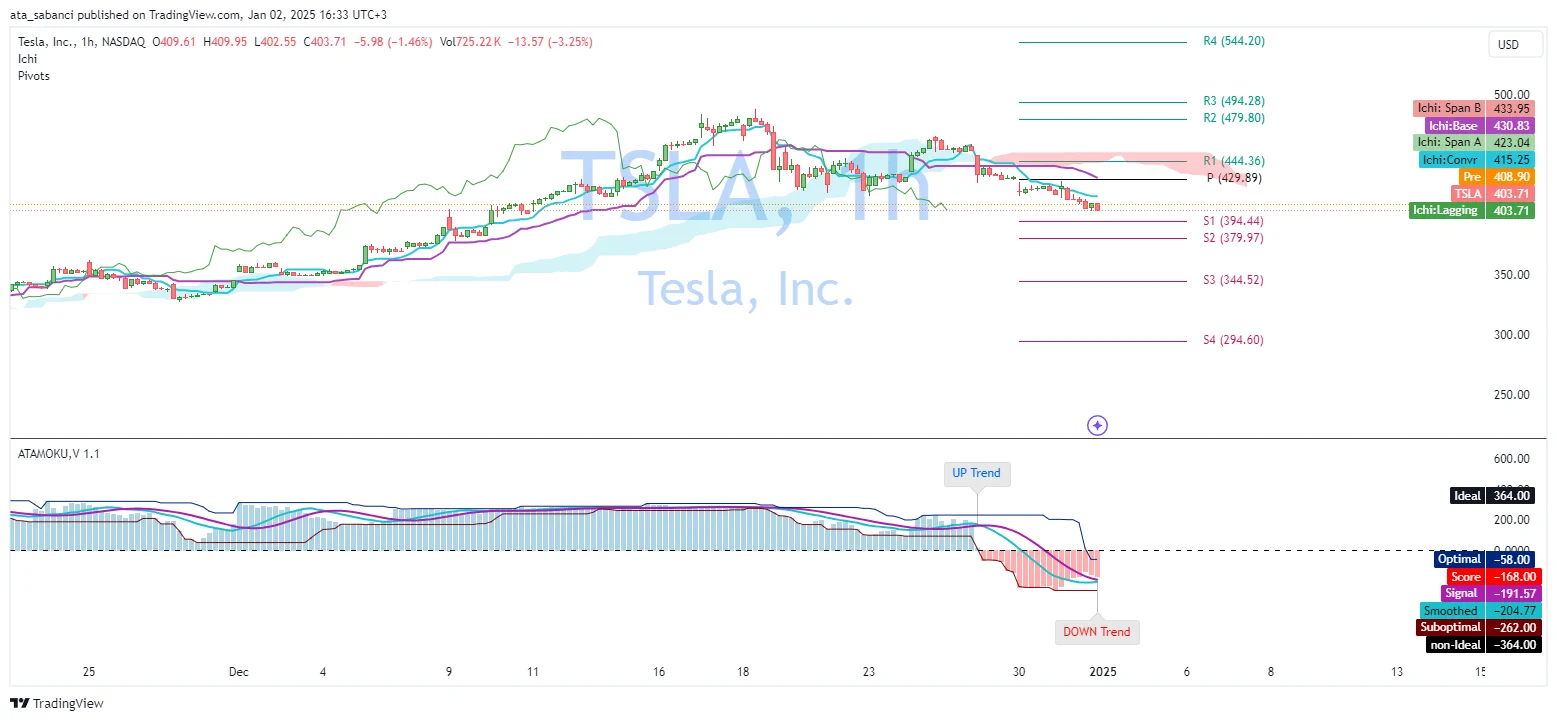

🚨 TSLA Short Position Entry with Ichimoku & ATAMOKU - January 2,2025 (No.1) 🔎 Today, I analyzed Tesla, Inc. (TSLA) using monthly, weekly, daily, and 1-hour charts with the Ichimoku Cloud and ATAMOKU indicator. Based on this analysis, I am entering a short position to test the effectiveness of these indicators in decision-making. Analysis Overview: 🟢 Monthly Chart: TSLA is trading above the Ichimoku Cloud, confirming a long-term bullish trend. The ATAMOKU score is positive (248), and resistance lies at R2 ($422.80). 🟡 Weekly Chart: The broader trend remains bullish, but TSLA shows signs of consolidation below R2 ($422.80). Key support is at the Base Line (Kijun-sen, $335.27). 🔴 Daily Chart: The price is nearing the Conversion Line ($445.54) but remains supported by the Ichimoku Cloud, suggesting caution in the medium term. ⚠️ 1-Hour Chart: Short-term bearish momentum dominates, with TSLA trading below the cloud. R1 ($444.36) acts as a key resistance level, while support lies at S1 ($394.44). Trade Execution: 📌 Action: Opened a short position of 5 shares at $444.36, targeting the short-term resistance on the 1-hour chart. This position aligns with the short-term bearish trend while respecting the broader market context. ------------------------------------------------------------- 💡 Disclaimer: This is an educational post. I’m using paper trading to demonstrate how traders apply indicators like Ichimoku and ATAMOKU in their decision-making process. For a deeper understanding of my journey, approach, and methodology, check out my earlier post as following: Always conduct your own research and analysis before trading. 📚 #StockMarket# #TSLA# #TeslaStock# #StockAnalysis# #IchimokuCloud# #ATAMOKU# #ShortPosition# #TechnicalAnalysis# #PriceAction# #TradingStrategy# #ChartAnalysis# #VolumeAndPrice# #StockTrader# #MarketTrends# #RiskManagement# #BearishMomentum# #TradingEducation# #NASDAQ# #InvestmentStrategy# #TrendAnalysis# #TransparencyInTrading# #PivotPoints# #FinancialMarkets# #DynamicSupport# #ResistanceLevel# #MarketBehavior# #LiveTrading# #StockCharts# #TechnicalIndicators# #TradingViewIdeas# #StockMarketEducation#